- Analisis

- Analisis Teknikal

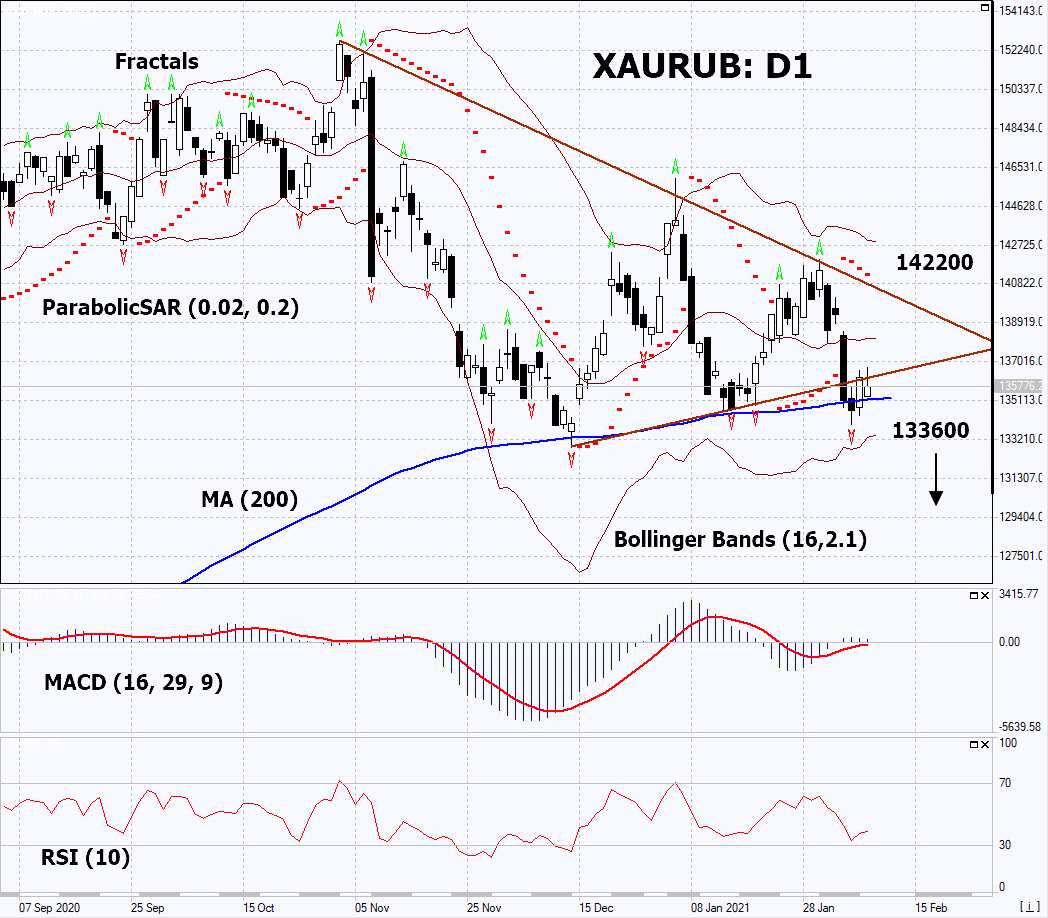

Emas vs Ruble Analisis Teknikal - Emas vs Ruble Berniaga: 2021-02-10

Emas vs Ruble Ringkasan Analisis Teknikal

Below 133600

Sell Stop

Above 142200

Stop Loss

| Penunjuk | Isyarat |

| RSI | berkecuali |

| MACD | berkecuali |

| MA(200) | berkecuali |

| Fractals | berkecuali |

| Parabolic SAR | Sell |

| Bollinger Bands | berkecuali |

Emas vs Ruble Analisis carta

Emas vs Ruble Analisis teknikal

On the daily timeframe, XAURUB: D1 broke down the uptrend support line and went down from the triangle. A number of technical analysis indicators formed signals for a further drop, despite the fact that in the last 2 days there has been a slight increase and a return to the broken trend line. We do not rule out a bearish movement if XAURUB falls below its last lower fractal and 200-day moving average line: 133600. This level can be used as an entry point. We can place a stop loss above the last upper fractal and Parabolic signal: 142200. After opening a pending order, we can move the stop loss following the Bollinger and Parabolic signals to the next fractal maximum. Thus, we change the potential profit/loss ratio in our favor. After the transaction, the most risk-averse traders can switch to the four-hour chart and set a stop loss, moving it in the direction of the bias. If the price meets the stop loss (142200) without activating the order (133600), it is recommended to delete the order: the market sustains internal changes that are usually not taken into account.

Analisis Asas bagi PCI - Emas vs Ruble

In this review, we propose to consider the &XAURUB Personal Composite Instrument (PCI). It reflects the changes in the value of gold against the Russian ruble. Will the XAURUB quotes downgrade?

The downward tendency means a slump in gold prices denominated in Russian rubles. Precious metals prices may stabilize during the Chinese New Year. Chinese people will get 7 days off on February 11-17 this year. The gold dynamics may be affected by the US inflation data due out on February 10, and the speech of the Federal Reserve Chair Jerome Powell. The Russian ruble may grow amid rising world oil prices. Hydrocarbons account for about 70% of Russian exports. Against this background, Morgan Stanley Bank announced an increase in investments in the ruble. Other Western investors are likely to join it.

Terokai kami

Syarat Dagangan

- Tersebar dari 0.0 pip

- 30,000+ Instrumen Perdagangan

- Tahap Henti Keluar - Hanya 10%

Bersedia untuk Berdagang?

Buka Akaun Perhatian:

Kajian berikut adalah berdasarkan maklumat kognitif dan diterbitkan secara percuma. Semua maklumat, terkandung dalam semakan semasa, diperolehi dari sumber umum, diakui sebagai tidak tepat sepenuhnya. Oleh yang demikian tidak dijamin, maklumat yang dipaparkan adalah tepat dan lengkap sepenuhnya. Ulasan kemudian tidak dikemaskini. Segala maklumat pada setiap ulasan, seperti ramalan, petunjuk, carta dan seumpama dengannya, hanya disertakan bagi tujuaan rujukan, dan bukan sebagai nasihat kewangan atau cadangan. Kesemua teks dan sebahagian darinya, dan termasuk juga carta, sesama sekali tidak boleh digunakan sebagai cadangan untuk membuat sebarang transaksi untuk sebarang saham. Syarikat IFC Markets dan pekerjanya tidak akan bertanggungjawab di bawah mana-mana keadaan untuk segala tindakan yang diambil oleh sesiapa selepas atau semasa ulasan.