- Analisis

- Analisis Teknikal

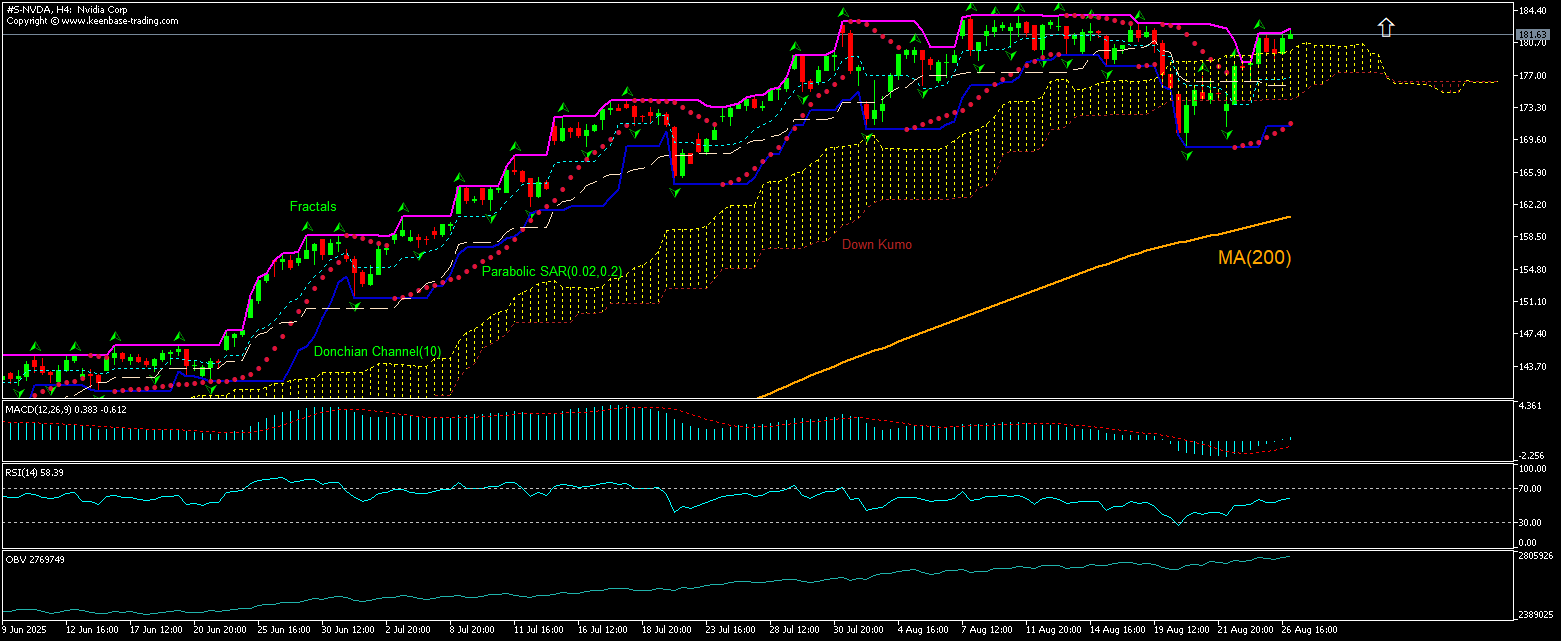

Nvidia Corp. Analisis Teknikal - Nvidia Corp. Berniaga: 2025-08-27

Nvidia Corp. Ringkasan Analisis Teknikal

Above 182.28

Buy Stop

Below 175.82

Stop Loss

| Penunjuk | Isyarat |

| RSI | berkecuali |

| MACD | Buy |

| Donchian Channel | Buy |

| MA(200) | Buy |

| Fractals | Buy |

| On Balance Volume | Buy |

| Ichimoku Kinko Hyo | Buy |

Nvidia Corp. Analisis carta

Nvidia Corp. Analisis teknikal

The technical analysis of the Nvidia stock price chart on 4-hour timeframe shows #S-NVDA,H4 has risen to upper boundary of trading range above the 200-period moving average MA(200) which is rising itself. We believe the bullish momentum will persist after the price breaches above the upper boundary of Donchian channel at 182.28. This level can be used as an entry point for placing a pending order to buy. The stop loss can be placed below 175.82. After placing the order, the stop loss is to be moved every day to the next fractal low, following Parabolic indicator signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (175.82) without reaching the order (182.28), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Analisis Asas bagi Saham - Nvidia Corp.

Nvidia stock price is poised to rise ahead of quarterly report today. Will the Nvidia stock price continue advancing?

Nvidia stock closed 1.09% higher yesterday ahead of second quarter report today after the market close. Analysts forecast Nvidia's revenue would rise 53% from a year ago to about $46 billion, according to FactSet research survey. They predict Nvidia will earn $1.01 per share, excluding certain items unrelated to its ongoing business, which would be a 49% increase from the same time last year. While the AI leader is expected to continue the trend of spectacular growth, Nvidia's revenue growth for its latest quarter is estimated to be significantly lower than the 122% increase it posted during the same period last year. Analysts are concerned about the business loss from president Trump's trade war with China. The ban on Nvidia’s AI chip sales in China resulted in a $4.5 billion blow to Nvidia’s finances during its fiscal first quarter. Nvidia estimates that the restrictions would cost it about approximately $8 billion in the second quarter as mentioned on the company’s first-quarter call. President Trump then allowed Nvidia the sales of chips to China in return for a 15% cut of the company's sales in that country. Beijing responded by ordering scrutiny of US - made chips, warning local AI developers against using foreign chips for critical processes. China had earlier in August asked major AI developers including Tencent and Bytedance to justify their purchases of the chips. And last week Nvidia asked some of its suppliers, including Amkor Technology Inc and Samsung Electronics Co Ltd, to halt production of components for its H20 chips, sales of which were reapproved by Washington. A bigger than expected Nvidia revenue loss from China chip sales is a downside risk for Nvidia stock price. However the current setup is bullish for Nvidia stock.

Terokai kami

Syarat Dagangan

- Tersebar dari 0.0 pip

- 30,000+ Instrumen Perdagangan

- Tahap Henti Keluar - Hanya 10%

Bersedia untuk Berdagang?

Buka Akaun Perhatian:

Kajian berikut adalah berdasarkan maklumat kognitif dan diterbitkan secara percuma. Semua maklumat, terkandung dalam semakan semasa, diperolehi dari sumber umum, diakui sebagai tidak tepat sepenuhnya. Oleh yang demikian tidak dijamin, maklumat yang dipaparkan adalah tepat dan lengkap sepenuhnya. Ulasan kemudian tidak dikemaskini. Segala maklumat pada setiap ulasan, seperti ramalan, petunjuk, carta dan seumpama dengannya, hanya disertakan bagi tujuaan rujukan, dan bukan sebagai nasihat kewangan atau cadangan. Kesemua teks dan sebahagian darinya, dan termasuk juga carta, sesama sekali tidak boleh digunakan sebagai cadangan untuk membuat sebarang transaksi untuk sebarang saham. Syarikat IFC Markets dan pekerjanya tidak akan bertanggungjawab di bawah mana-mana keadaan untuk segala tindakan yang diambil oleh sesiapa selepas atau semasa ulasan.