- Analisis

- Analisis Teknikal

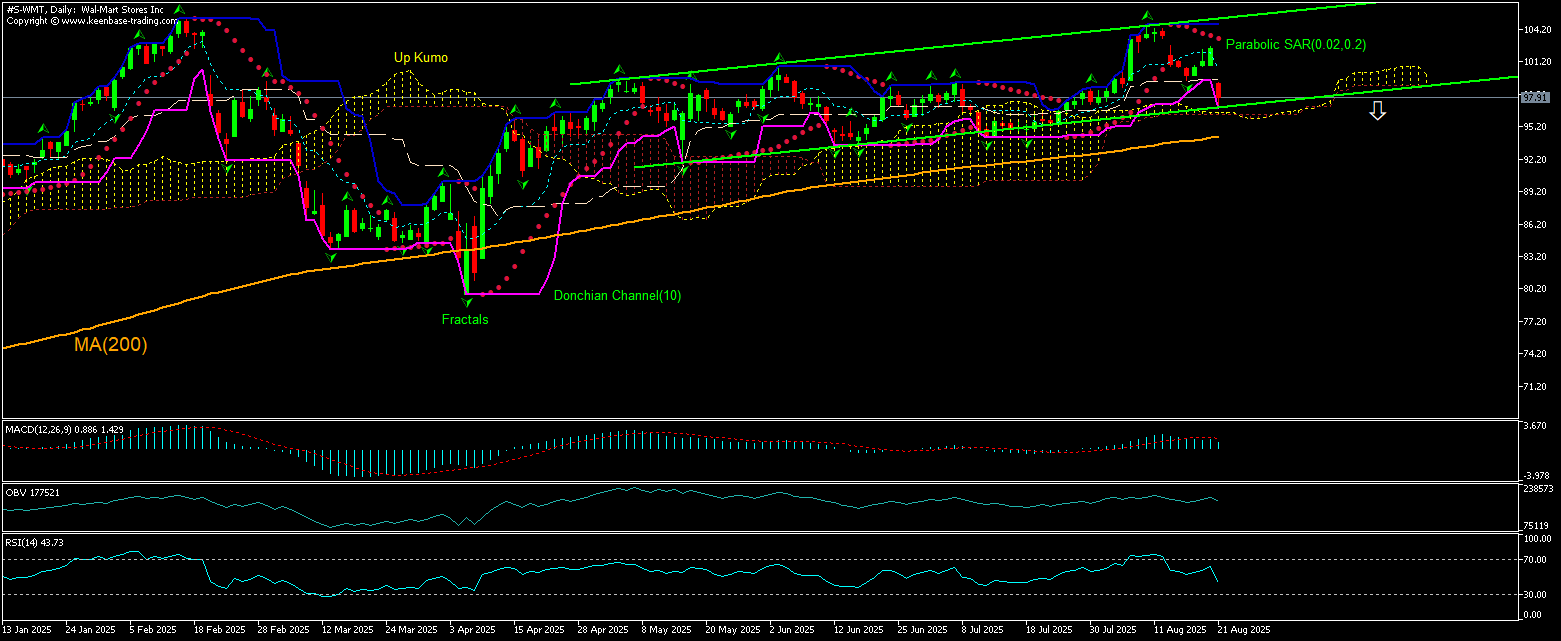

Wal-Mart Stores Analisis Teknikal - Wal-Mart Stores Berniaga: 2025-08-22

Wal-Mart Stores Ringkasan Analisis Teknikal

Below 96.35

Sell Stop

Above 103.35

Stop Loss

| Penunjuk | Isyarat |

| RSI | berkecuali |

| MACD | Sell |

| Donchian Channel | Sell |

| MA(200) | Buy |

| Fractals | berkecuali |

| Parabolic SAR | Sell |

| On Balance Volume | Sell |

| Ichimoku Kinko Hyo | Buy |

Wal-Mart Stores Analisis carta

Wal-Mart Stores Analisis teknikal

The technical analysis of the Walmart stock price chart on 4-hour timeframe shows #S-WMT,H4 is retracing down toward the 200-period moving average MA(200) after hitting 6-month high 2 weeks ago. We believe the bearish momentum will resume after the price breaches below the lower Donchian bound at 97.91. A level below this can be used as an entry point for placing a pending order to sell. The stop loss can be placed at 103.35. After placing the order, the stop loss is to be moved every day to the next fractal high indicator, following Parabolic indicator signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (103.35) without reaching the order (96.35), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Analisis Asas bagi Saham - Wal-Mart Stores

Walmart stock tumbled after Q2 earnings missed Wall Street estimates. Will the Walmart stock price continue retreating?

Walmart stock fell 4.5% yesterday as earnings missed Wall Street estimates. The stock sold off despite 4.8% rise in Q2 sales to $177.4 billion which beat the consensus revenue estimate of $175.5 billion. Overall gross margins were about flat at 24.5% versus 24.4% last quarter, missing consensus estimates of 24.9%. On a constant-currency basis, revenues grew 5.6%, reflecting strong performance across all business segments. Walmart stock sold off despite reporting better results than rival Target. Walmart's comparable sales growth at stores open at least one year was 4.6% in Q2, up from 4.2% one year ago. Transactions rose 1.5%, down from 3.6% last year, while average ticket, or the amount spent per transaction, rose 3.1%, up from 0.6%. For comparison, Target reported a 1.9% comparable sales decline and an online sales growth of only 4.3% in the quarter. The retail and wholesale giant indicated the average ticket growth was partly due to inflation and passing along higher costs associated with tariffs, which increased Walmart's import costs, and the company would increase prices this summer as announced earlier to offset tariff-related costs. Walmart said it continued to see cost increases each week as inventory was replenished at post-tariff price levels and those costs will continue rising in the second half of the year. However, the company reported tariff impact wasn't as big as expected so far as Walmart has raised prices maybe 1% since the end of the first quarter. The company’s operating income decreased 8.2% year over year to $7.3 billion. The company cited tariffs as the primary challenge, as well as discrete legal and restructuring costs. Adjusted operating income is up 0.4% in current currency terms. Still, management raised its full-year guidance: sales guidance was increased to 3.75% to 4.75% growth from 3% to 4% prior forecast while operating income growth guidance was unchanged - up 3.5% to 5.5%. Higher than expected revenue growth and guidance is bullish for Walmart stock price while earnings miss is a downside risk.

Terokai kami

Syarat Dagangan

- Tersebar dari 0.0 pip

- 30,000+ Instrumen Perdagangan

- Tahap Henti Keluar - Hanya 10%

Bersedia untuk Berdagang?

Buka Akaun Perhatian:

Kajian berikut adalah berdasarkan maklumat kognitif dan diterbitkan secara percuma. Semua maklumat, terkandung dalam semakan semasa, diperolehi dari sumber umum, diakui sebagai tidak tepat sepenuhnya. Oleh yang demikian tidak dijamin, maklumat yang dipaparkan adalah tepat dan lengkap sepenuhnya. Ulasan kemudian tidak dikemaskini. Segala maklumat pada setiap ulasan, seperti ramalan, petunjuk, carta dan seumpama dengannya, hanya disertakan bagi tujuaan rujukan, dan bukan sebagai nasihat kewangan atau cadangan. Kesemua teks dan sebahagian darinya, dan termasuk juga carta, sesama sekali tidak boleh digunakan sebagai cadangan untuk membuat sebarang transaksi untuk sebarang saham. Syarikat IFC Markets dan pekerjanya tidak akan bertanggungjawab di bawah mana-mana keadaan untuk segala tindakan yang diambil oleh sesiapa selepas atau semasa ulasan.