- Analisis

- Analisis Teknikal

USD/CAD Analisis Teknikal - USD/CAD Berniaga: 2017-06-29

Accelerating economic recovery is bullish for Canadian dollar

Canadian employment rose more than expected in May and central bank policy makers’ recent hawkish comments surprised investors. Will the Canadian dollar continue strengthening?

The Bank of Canada left the interest rate unchanged at 0.5% at May 28 policy meeting and maintained a neutral stance for interest rate hikes. However a hawkish change in comments by central bank’s head and his deputy made two weeks ago brought up reassessment of the likelihood of policy tightening possibly as early as in July. Senior Deputy Governor Carolyn Wilkins said in a speech the bank “will be assessing whether all of the considerable monetary policy stimulus presently in place is still required.” Governor Poloz commented next day the two 2015 rate cuts have done their job and Canada now has “a much more diverse kind of recovery.’’ Last employment report supported the view of accelerating growth: the 25,300 increase in manufacturing jobs was the biggest since 2002, and annual wage rate increases accelerated to 1.3% in May. Statistics Canada will report April GDP data on Friday, an 0.2% growth on the month and 3.4% from a year earlier is expected, the fastest pace since June of 2014. Continued recovery of economy is bullish for Canadian dollar.

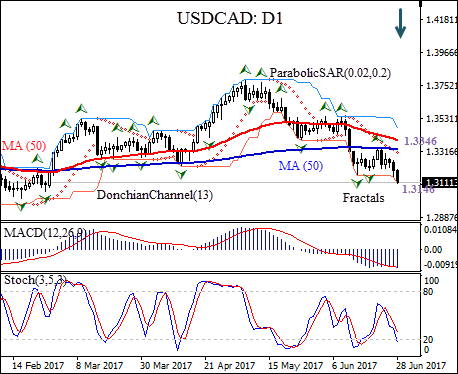

USDCAD: D1 has been trading with a negative bias on the daily timeframe since it hit a fifteen-month high in the beginning of May. The price is below the 50-day and 200-day moving averages MA(50) and MA(200), both on decline after levelling off.

- The Donchian channel gives a bearish signal: it is tilted downward.

- The Parabolic indicator has formed a sell signal.

- The MACD indicator gives a bearish signal.

- The stochastic oscillator has breached into the oversold zone which is a bullish signal.

We expect the bearish momentum will continue after the price closes below the lower bound of the Donchian channel at 1.3146. It can be used as an entry point for a pending order to sell. The stop loss can be placed above the last fractal high at 1.3346. After placing the pending order the stop loss is to be moved to the next fractal high following Parabolic signals. Thus, we are changing the profit/loss ratio to the breakeven point. If the price meets the stop loss level (1.3346) without reaching the order (1.3146), we recommend cancelling the position: the market sustains internal changes which were not taken into account.

Technical Analysis Summary

| Position | Sell |

| Sell stop | Below 1.3146 |

| Stop loss | Above 1.3346 |

Perhatian:

Kajian berikut adalah berdasarkan maklumat kognitif dan diterbitkan secara percuma. Semua maklumat, terkandung dalam semakan semasa, diperolehi dari sumber umum, diakui sebagai tidak tepat sepenuhnya. Oleh yang demikian tidak dijamin, maklumat yang dipaparkan adalah tepat dan lengkap sepenuhnya. Ulasan kemudian tidak dikemaskini. Segala maklumat pada setiap ulasan, seperti ramalan, petunjuk, carta dan seumpama dengannya, hanya disertakan bagi tujuaan rujukan, dan bukan sebagai nasihat kewangan atau cadangan. Kesemua teks dan sebahagian darinya, dan termasuk juga carta, sesama sekali tidak boleh digunakan sebagai cadangan untuk membuat sebarang transaksi untuk sebarang saham. Syarikat IFC Markets dan pekerjanya tidak akan bertanggungjawab di bawah mana-mana keadaan untuk segala tindakan yang diambil oleh sesiapa selepas atau semasa ulasan.