- Analisis

- Analisis Teknikal

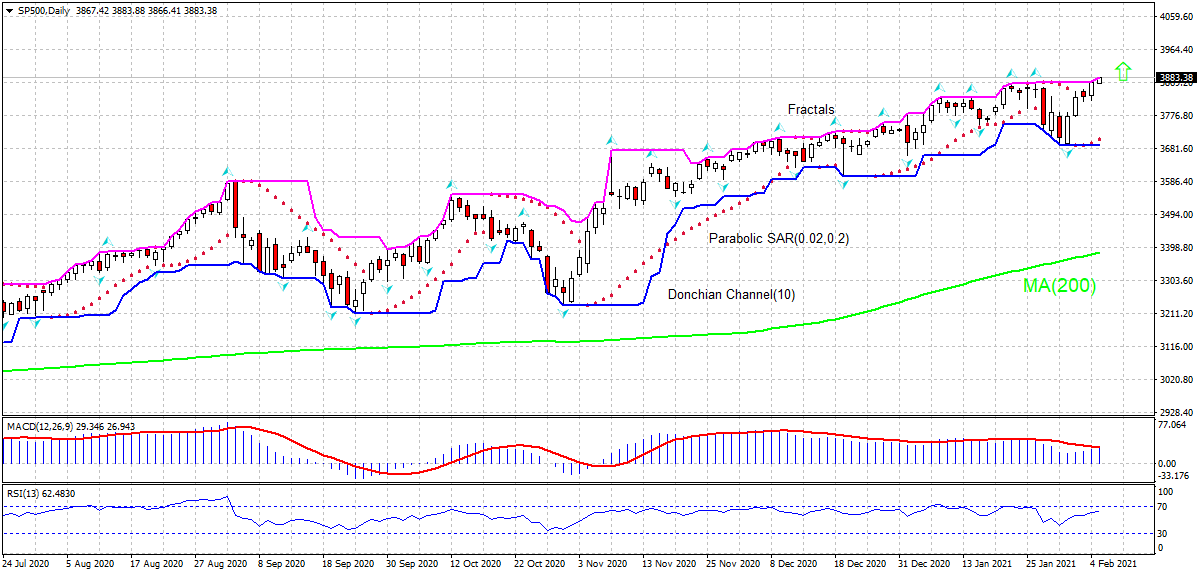

S&P 500 Analisis Teknikal - S&P 500 Berniaga: 2021-02-05

Standard & Poor’s (500), Indeks pasaran saham Ringkasan Analisis Teknikal

Above 3883.91

Buy Stop

Below 3690.32

Stop Loss

| Penunjuk | Isyarat |

| RSI | berkecuali |

| MACD | Buy |

| Donchian Channel | Buy |

| MA(200) | Buy |

| Fractals | berkecuali |

| Parabolic SAR | Buy |

Standard & Poor’s (500), Indeks pasaran saham Analisis carta

Standard & Poor’s (500), Indeks pasaran saham Analisis teknikal

The SP500 technical analysis of the price chart on the daily timeframe shows the SP00,Daily is rebounding above the 200-day moving average MA(200) which is rising itself. The SP500 forecast is bullish according to the SP500 chart analysis. We believe the bullish momentum will continue after the price breaches above the upper boundary of Donchian channel at 3883.91. A level above this can be used as an entry point for placing a pending order to buy. The stop loss can be placed below 3690.32. After placing the order, the stop loss is to be moved every day to the next fractal low, following Parabolic indicator signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (3690.32) without reaching the order (3883.91), we recommend cancelling the order: the market has undergone internal changes which were not taken into account

Analisis Asas bagi Indeks - Standard & Poor’s (500), Indeks pasaran saham

US economic data were largely positive recently. Will the SP500 rebound continue?

US economic data of the recent week were positive on balance. New jobless claims filed last week in US were lower than expected, and services sectors continued its expansions at faster rate. Thus, the US Labor Department reported 779 thousand Americans sought unemployment benefits over the last week, down from 812 thousand the previous week. And the Institute for Supply Management’s Non-manufacturing PMI index came in at 58.7 for January, after a reading of 57.7 for December. Readings above 50.0 indicate industry expansion, below indicate contraction. Furthermore, US factory orders rose 1.1% over month in December after 1.3% growth in November when 0.7% growth was expected. And US lawmakers are negotiating an agreement on a new stimulus for US economy. Democratic leaders have backed a $1.9 trillion bipartisan proposal, and while Republicans have proposed a smaller package the House of Representatives approved a budget plan on Wednesday that would allow it to pass the $1.9 trillion coronavirus package without a single Republican vote if necessary. Positive US data are bullish for SP500.

Terokai kami

Syarat Dagangan

- Tersebar dari 0.0 pip

- 30,000+ Instrumen Perdagangan

- Tahap Henti Keluar - Hanya 10%

Bersedia untuk Berdagang?

Buka Akaun Perhatian:

Kajian berikut adalah berdasarkan maklumat kognitif dan diterbitkan secara percuma. Semua maklumat, terkandung dalam semakan semasa, diperolehi dari sumber umum, diakui sebagai tidak tepat sepenuhnya. Oleh yang demikian tidak dijamin, maklumat yang dipaparkan adalah tepat dan lengkap sepenuhnya. Ulasan kemudian tidak dikemaskini. Segala maklumat pada setiap ulasan, seperti ramalan, petunjuk, carta dan seumpama dengannya, hanya disertakan bagi tujuaan rujukan, dan bukan sebagai nasihat kewangan atau cadangan. Kesemua teks dan sebahagian darinya, dan termasuk juga carta, sesama sekali tidak boleh digunakan sebagai cadangan untuk membuat sebarang transaksi untuk sebarang saham. Syarikat IFC Markets dan pekerjanya tidak akan bertanggungjawab di bawah mana-mana keadaan untuk segala tindakan yang diambil oleh sesiapa selepas atau semasa ulasan.