- Analisis

- Analisis Teknikal

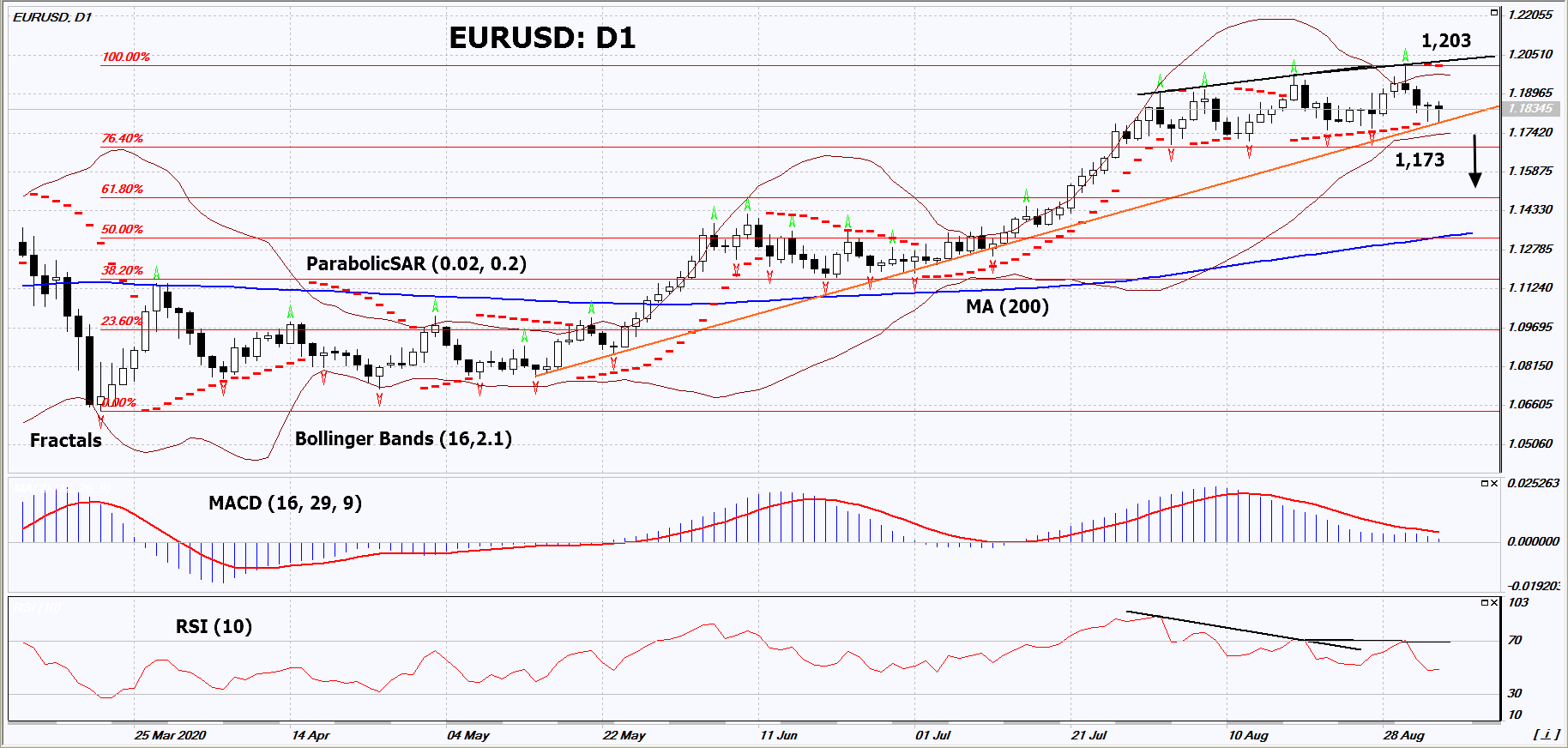

EUR/USD Analisis Teknikal - EUR/USD Berniaga: 2020-09-07

EUR/USD Ringkasan Analisis Teknikal

Below 1,173

Sell Stop

Above 1,203

Stop Loss

| Penunjuk | Isyarat |

| RSI | Sell |

| MACD | Sell |

| MA(200) | berkecuali |

| Fractals | berkecuali |

| Parabolic SAR | Sell |

| Bollinger Bands | berkecuali |

EUR/USD Analisis carta

EUR/USD Analisis teknikal

On the daily timeframe, EURUSD: D1 approached the uptrend support level. It must be broken down before opening a position. A number of technical analysis indicators show signals of further growth. We do not exclude a bearish movement if EURUSD falls below the last 2 lower fractals and the lower Bollinger line: 1.173. This level can be used as an entry point. We can set a stop loss above the Parabolic signal, the upper Bollinger band, the high since April 2018 and the last high fractal: 1.203. After opening a pending order, we can move the stop loss to the next fractal maximum following the Bollinger and Parabolic signals. Thus, we change the potential profit/loss ratio in our favor. After the transaction, the most risk-averse traders can switch to the four-hour chart and set a stop loss, moving it in the direction of the bias. If the price meets the stop loss (1.203) without activating the order (1.173), it is recommended to delete the order: some internal changes in the market have not been taken into account.

Analisis Asas bagi Forex - EUR/USD

The recovery of the European economy is slowing down after the coronavirus pandemic. Will the euro quotations decline?

Retail sales in the Eurozone fell by 1.3% monthly in July. This is much worse than both forecast of + 1.5%, and their June result of + 5.3%. Retail sales in Germany fell 0.9% month-on-month in July, while a 0.5% rise was expected. In the United States, retail sales grew by 1.2% in July. Industrial orders in Germany increased by 2.8% in July. This is worse than the forecast ( 5%) and the June figure ( 28.8%). Compared to the mid-March rate, EURUSD is now traded 11% higher. Last week, the ECB chief economist Philip Lane expressed concern about the over-strengthening of the European single currency. In theory, given the current low inflation, the ECB may go for additional monetary easing, since they believe that too strong euro reduces the efficiency of European exports. Recall that in August, the Eurozone's consumer prices growth slowed to 0.4% in annual terms from 1.2% in July.

Terokai kami

Syarat Dagangan

- Tersebar dari 0.0 pip

- 30,000+ Instrumen Perdagangan

- Tahap Henti Keluar - Hanya 10%

Bersedia untuk Berdagang?

Buka Akaun Perhatian:

Kajian berikut adalah berdasarkan maklumat kognitif dan diterbitkan secara percuma. Semua maklumat, terkandung dalam semakan semasa, diperolehi dari sumber umum, diakui sebagai tidak tepat sepenuhnya. Oleh yang demikian tidak dijamin, maklumat yang dipaparkan adalah tepat dan lengkap sepenuhnya. Ulasan kemudian tidak dikemaskini. Segala maklumat pada setiap ulasan, seperti ramalan, petunjuk, carta dan seumpama dengannya, hanya disertakan bagi tujuaan rujukan, dan bukan sebagai nasihat kewangan atau cadangan. Kesemua teks dan sebahagian darinya, dan termasuk juga carta, sesama sekali tidak boleh digunakan sebagai cadangan untuk membuat sebarang transaksi untuk sebarang saham. Syarikat IFC Markets dan pekerjanya tidak akan bertanggungjawab di bawah mana-mana keadaan untuk segala tindakan yang diambil oleh sesiapa selepas atau semasa ulasan.