- Analisis

- Analisis Teknikal

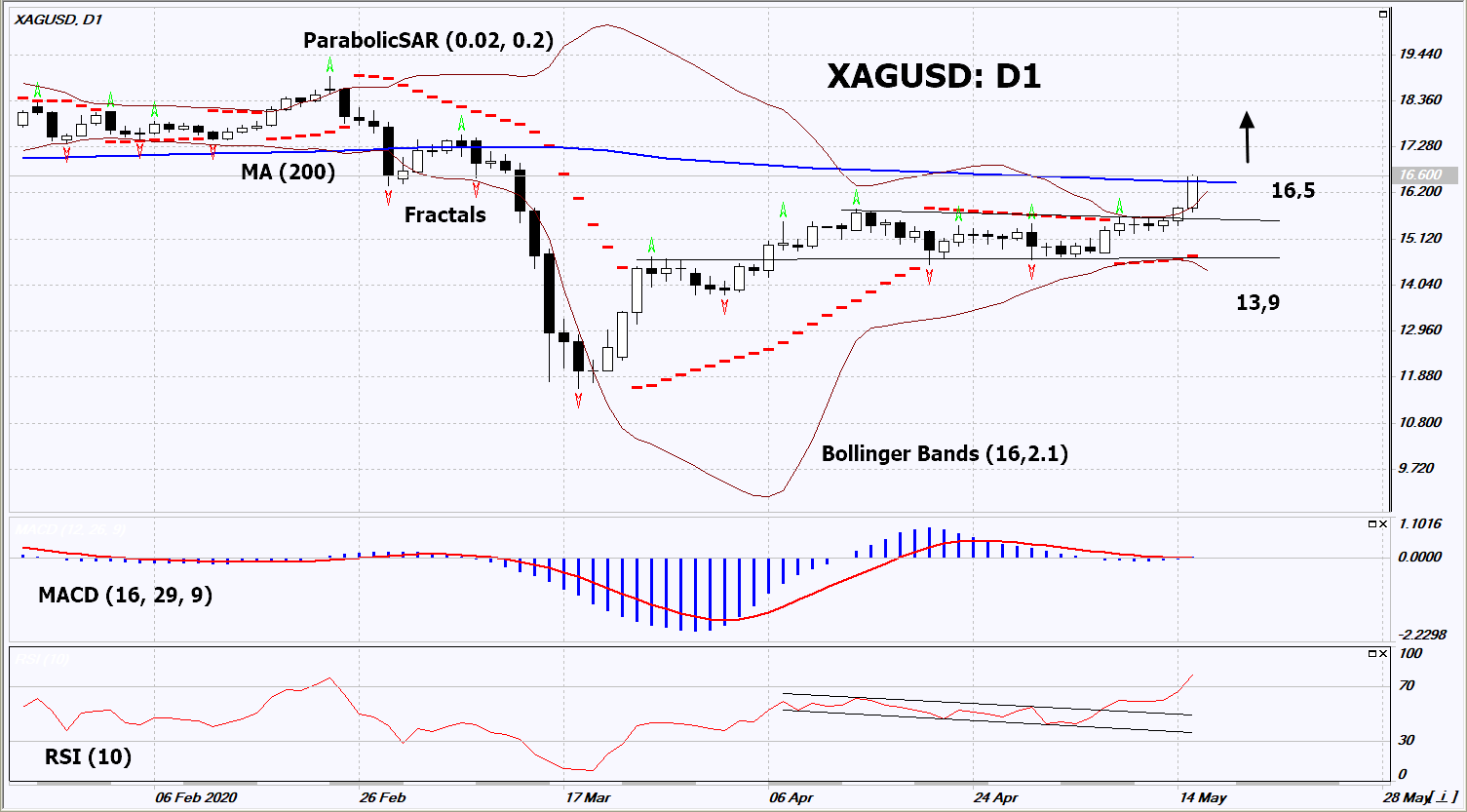

Perak/Dolar AS Analisis Teknikal - Perak/Dolar AS Berniaga: 2020-05-18

Perak Ringkasan Analisis Teknikal

Above 16,5

Buy Stop

Below 13,9

Stop Loss

| Penunjuk | Isyarat |

| RSI | Sell |

| MACD | berkecuali |

| MA(200) | Buy |

| Fractals | Buy |

| Parabolic SAR | Buy |

| Bollinger Bands | berkecuali |

Perak Analisis carta

Perak Analisis teknikal

On the daily timeframe, XAGUSD: D1 broke through the upper boundary of the short-term neutral trend. A number of indicators of technical analysis formed signals for a further increase. We do not exclude a bullish movement if XAGUSD rises above its last maximum, the 200-day moving average line and the upper Bollinger line: 16.5. This level can be used as an entry point. We can set a stop loss below the Parabolic signal, the lower Bollinger line, the last 2 lower fractals: 13.9. After opening the pending order, we move the stop loss following the Bollinger and Parabolic signals to the next fractal minimum. Thus, we change the potential profit/loss ratio in our favor. After the transaction, the most risk-averse traders can switch to a four-hour chart and set a stop loss, moving it in the direction of the trend. If the price meets the stop loss level (13.9) without activating the order (16.5), it is recommended to delete the order: market sustains internal changes not taken into account.

Analisis Asas bagi Logam Berharga - Perak

Weak US economic data boosted demand for precious metals. Will XAGUSD quotes grow?

US retail sales in April showed a record drop of 16.2% (month to month) since 1992, when they were first calculated. This is worse than the forecast (-12%). In March, retail sales fell by 8.3%. This indicator reflects the economic situation and investors now fear that the decline in US GDP in the 2nd quarter of 2020 may be a record (up to -40%, according to various estimates) since the 30s of the last century, a period known as the "Great Depression" in the country. Let us recall that GDP fell by 4.8 % in the 1st quarter. Another negative macroeconomic factor was the very weak data on the American labor market for April, published 2 weeks ago, as well as the statement by Fed Chairman Jerome Powell that the economic recovery will be long and painful. Another risk factor is the worsening of US-China trade relations as coronavirus pandemic fades. It should be noted that the United States industrial production indicator for April was better than expected. Earlier, China demonstrated a good pace of industrial recovery. This may have contributed to the rise in the silver price, which is both a precious metal, and is used in industry, in particular, when manufacturing electric cars. In turn, investors have long been buying gold. Its reserves in the world's largest SPDR Gold Trust fund reached a 7-year high of 1104.7 tons.

Perhatian:

Kajian berikut adalah berdasarkan maklumat kognitif dan diterbitkan secara percuma. Semua maklumat, terkandung dalam semakan semasa, diperolehi dari sumber umum, diakui sebagai tidak tepat sepenuhnya. Oleh yang demikian tidak dijamin, maklumat yang dipaparkan adalah tepat dan lengkap sepenuhnya. Ulasan kemudian tidak dikemaskini. Segala maklumat pada setiap ulasan, seperti ramalan, petunjuk, carta dan seumpama dengannya, hanya disertakan bagi tujuaan rujukan, dan bukan sebagai nasihat kewangan atau cadangan. Kesemua teks dan sebahagian darinya, dan termasuk juga carta, sesama sekali tidak boleh digunakan sebagai cadangan untuk membuat sebarang transaksi untuk sebarang saham. Syarikat IFC Markets dan pekerjanya tidak akan bertanggungjawab di bawah mana-mana keadaan untuk segala tindakan yang diambil oleh sesiapa selepas atau semasa ulasan.