- Analisis

- Analisis Teknikal

GBP/USD Analisis Teknikal - GBP/USD Berniaga: 2025-06-23

GBP/USD Ringkasan Analisis Teknikal

Above 2255.75

Buy Stop

Below 2170.46

Stop Loss

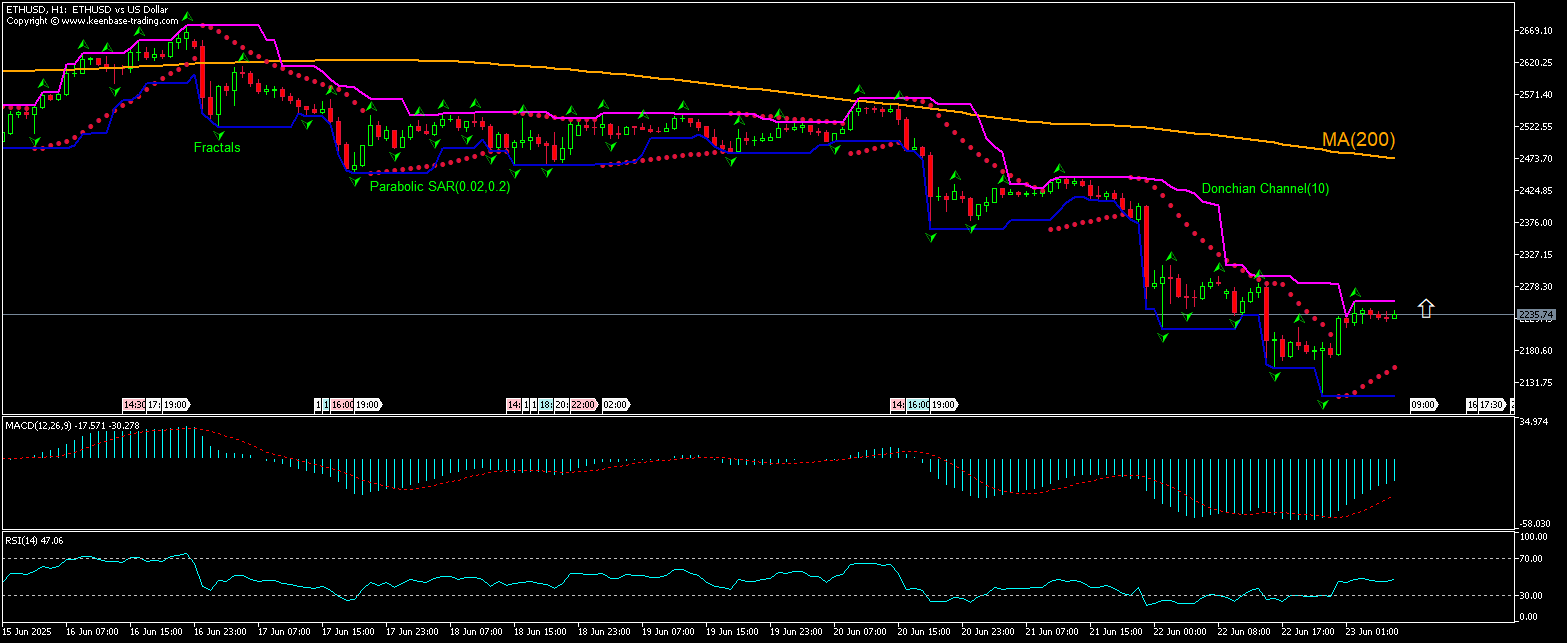

| Penunjuk | Isyarat |

| RSI | berkecuali |

| MACD | Buy |

| Donchian Channel | berkecuali |

| MA(200) | Sell |

| Fractals | berkecuali |

| Parabolic SAR | Buy |

GBP/USD Analisis carta

GBP/USD Analisis teknikal

The ETHUSD technical analysis of the price chart on 4-hour timeframe shows ETHUSD, H4 is rebounding toward the 200-period moving average MA(200) after retracing down to six-week low yesterday. We believe the bullish momentum will continue after the price breaches above upper Donchian channel boundary at 2255.75. A level above this can be used as an entry point for placing a pending order to buy. The stop loss can be placed below 2170.46. After placing the order, the stop loss is to be moved to the next fractal low, following Parabolic indicator signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level without reaching the order, we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Analisis Asas bagi Forex - GBP/USD

Ethereum is rebounding despite news of latest whale distribution wave. Will the ETHUSD price reverse rebounding?

CrytpoQuant reports that major Ethereum holders, often referred to as “whales,” are actively engaging in a second significant round of profit-taking. Data reveal that wallets holding 100,000+ ETH, often referred to as “whales,” are actively reducing exposure through large-scale distribution. Historically, when whales start selling significant portions of their holdings, it sends a cautionary signal to the broader market as traders reason that actions of sophisticated investors reflect their expectations for near-term price movements. It is interpreted as a cautious outlook on Ethereum’s ability on part of sophisticated investors to deliver significant short-term upside from its present valuation. On the fundamental level, this distributing of part of whales’ holdings into the market amounts to increased selling activity by whales, which injects additional supply into the market. If this surge in supply isn’t matched by higher demand, it can create downward pressure on Ethereum’s price, potentially limiting its near-term growth. Increased selling of Ethereum by whales is bearish for ETHUSD price. However, the current setup is bullish for the ETHUSD.

Terokai kami

Syarat Dagangan

- Tersebar dari 0.0 pip

- 30,000+ Instrumen Perdagangan

- Pelaksanaan Segera

Bersedia untuk Berdagang?

Buka Akaun Perhatian:

Kajian berikut adalah berdasarkan maklumat kognitif dan diterbitkan secara percuma. Semua maklumat, terkandung dalam semakan semasa, diperolehi dari sumber umum, diakui sebagai tidak tepat sepenuhnya. Oleh yang demikian tidak dijamin, maklumat yang dipaparkan adalah tepat dan lengkap sepenuhnya. Ulasan kemudian tidak dikemaskini. Segala maklumat pada setiap ulasan, seperti ramalan, petunjuk, carta dan seumpama dengannya, hanya disertakan bagi tujuaan rujukan, dan bukan sebagai nasihat kewangan atau cadangan. Kesemua teks dan sebahagian darinya, dan termasuk juga carta, sesama sekali tidak boleh digunakan sebagai cadangan untuk membuat sebarang transaksi untuk sebarang saham. Syarikat IFC Markets dan pekerjanya tidak akan bertanggungjawab di bawah mana-mana keadaan untuk segala tindakan yang diambil oleh sesiapa selepas atau semasa ulasan.