- Analisis

- Analisis Teknikal

Perak/Dolar AS Analisis Teknikal - Perak/Dolar AS Berniaga: 2017-01-04

Demand emerges for precious metals industrial use

Silver Institute predicts an increase in global demand for silver due to its industrial use in the production of solar panels (photovoltaic) and as a catalyst for the chemical production of ethylene oxide. In addition, the metal is used in other types of industry as well. Will silver advance?

According to the Silver Institute, only these two uses of silver may increase global demand by 32% by 2020 compared to the level of 2015. Another factor in the growth of the consumption of this metal can become the active production of devices for cleaning the air and fighting smog in China. It should be noted that besides industry, silver is also used in jewelry manufacturing and for investment purposes. According to the GFMS, in 2016 there was recorded a negative balance of supply and demand for silver in the amount of minus 186 million ounces in the world market (maximum since 2008). Due to this, for the first time in 4 years its value increased by 14% overtaking gold which prices advanced 7% over the last year. In 2017, it is expected to have a decline in the world silver deficit up to minus 50-52 ounces. Nevertheless, many market participants expect that the average price of this precious metal may rise approximately by 20% in the current year compared to the level of 2016. The deficit of silver is covered at the expense of use of world stocks.

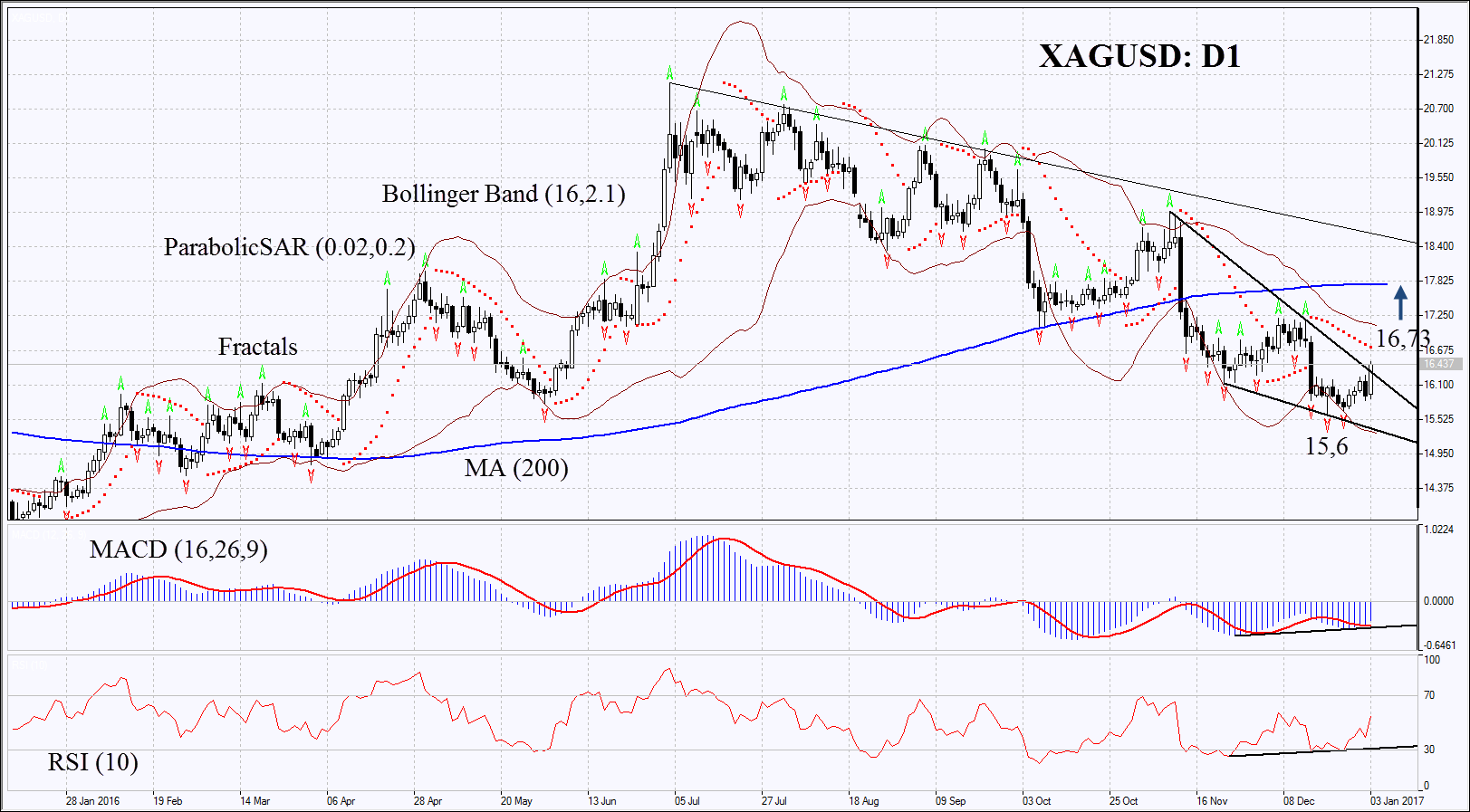

In the daily chart XAGUSD: D1 is trying to correct upwards from the 9-month low, but it keeps trending downwards. Accordingly, in order to open a buy position, the exchange rate should exceed its resistance level. Further price increase is possible in case of acceleration of global industrial growth and increase in demand for silver.

- Parabolic indicator gives a bullish signal.

- Bollinger bands have widened which indicates high volatility.

- RSI is below 50. It has formed positive divergence.

- MACD gives a bullish signal.

The bullish momentum may develop in case silver surpasses the resistance level of the downward trend and the Parabolic signal at 16, 73. The initial stop-loss may be placed below the last two fractal lows and the 9-month low at 15, 6. After opening the pending order we shall move the stop to the next fractal low following the Parabolic and Bollinger signals. Thus, we are changing the probable profit/loss ratio to the breakeven point. The most risk-averse traders may switch to the 4-hour chart after the trade and place there a stop-loss moving it in the direction of the trade. If the price meets the stop-loss level at 15, 6 without reaching the order at 16, 73, we recommend cancelling the position: the market sustains internal changes which were not taken into account.

Technical Analysis Summary

| Position | Buy |

| Buy stop | above 16,73 |

| Stop loss | below 15,6 |

Terokai kami

Syarat Dagangan

- Tersebar dari 0.0 pip

- 30,000+ Instrumen Perdagangan

- Tahap Henti Keluar - Hanya 10%

Bersedia untuk Berdagang?

Buka Akaun Perhatian:

Kajian berikut adalah berdasarkan maklumat kognitif dan diterbitkan secara percuma. Semua maklumat, terkandung dalam semakan semasa, diperolehi dari sumber umum, diakui sebagai tidak tepat sepenuhnya. Oleh yang demikian tidak dijamin, maklumat yang dipaparkan adalah tepat dan lengkap sepenuhnya. Ulasan kemudian tidak dikemaskini. Segala maklumat pada setiap ulasan, seperti ramalan, petunjuk, carta dan seumpama dengannya, hanya disertakan bagi tujuaan rujukan, dan bukan sebagai nasihat kewangan atau cadangan. Kesemua teks dan sebahagian darinya, dan termasuk juga carta, sesama sekali tidak boleh digunakan sebagai cadangan untuk membuat sebarang transaksi untuk sebarang saham. Syarikat IFC Markets dan pekerjanya tidak akan bertanggungjawab di bawah mana-mana keadaan untuk segala tindakan yang diambil oleh sesiapa selepas atau semasa ulasan.