- Analisis

- Analisis Teknikal

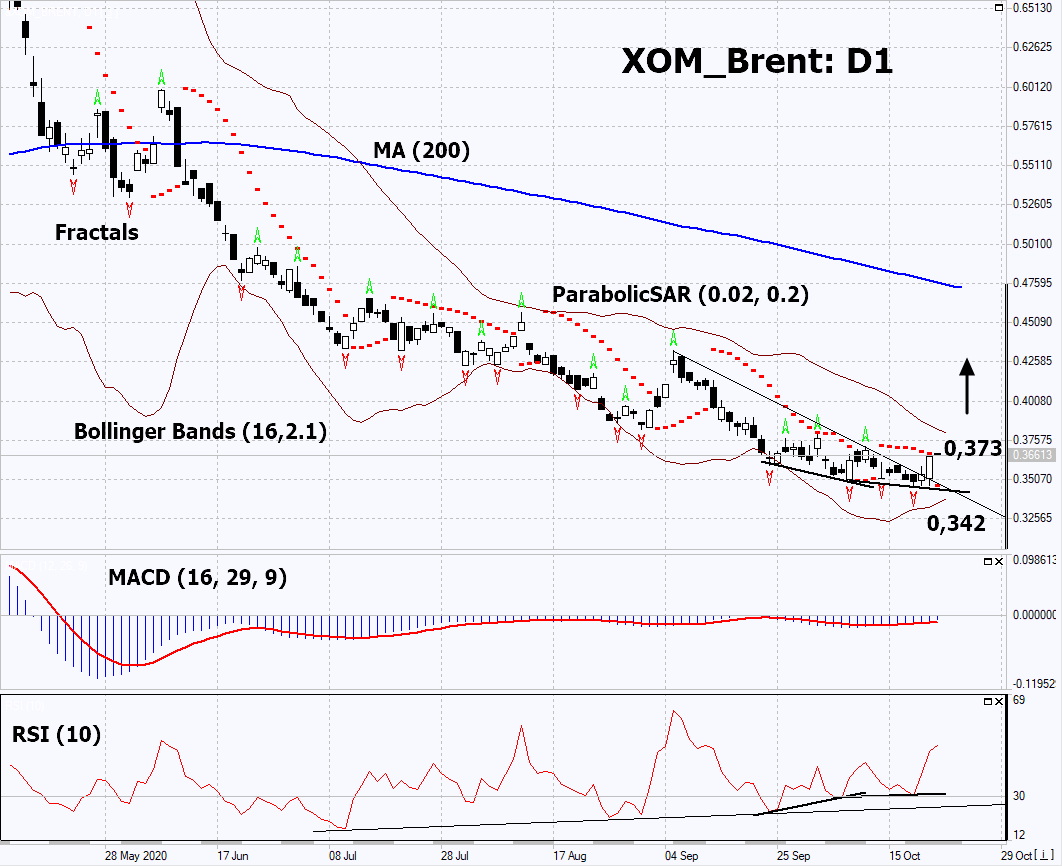

Saham Exxon Mobil vs Brent Analisis Teknikal - Saham Exxon Mobil vs Brent Berniaga: 2020-10-26

Saham Exxon Mobil vs Brent Ringkasan Analisis Teknikal

Above 0,373

Buy Stop

Below 0,342

Stop Loss

| Penunjuk | Isyarat |

| RSI | Buy |

| MACD | Buy |

| MA(200) | berkecuali |

| Fractals | berkecuali |

| Parabolic SAR | Buy |

| Bollinger Bands | berkecuali |

Saham Exxon Mobil vs Brent Analisis carta

Saham Exxon Mobil vs Brent Analisis teknikal

On the daily timeframe, XOM_Brent: D1 is trying to correct upward from a 7-year minimum and exceeded the downtrend resistance line. A number of technical analysis indicators formed signals for further growth. We do not exclude a bullish movement if XOM_Brent rises above the last upper fractal: 0.373. This level can be used as an entry point. We can place a stop loss below the Parabolic signal and the lower fractal: 0.342. After opening a pending order, we can move the stop loss to the next fractal low following the Bollinger and Parabolic signals. Thus, we change the potential profit/loss ratio in our favor. After the transaction, the most risk-averse traders can switch to the 4-hour chart and place a stop loss, moving it in the direction of the bias. If the price meets the stop loss (0.342) without activating the order (0.373), it is recommended to delete the order: the market sustains internal changes that have not been taken into account.

Analisis Asas bagi PCI - Saham Exxon Mobil vs Brent

In this review, we propose to consider the XOM_Brent personal composite instrument (PCI). It reflects the price action of the stocks of Exxon Mobil Corporation (an American oil company) against Brent oil futures. Will the XOM_Brent quotes increase?

The growth of this PCI means that Exxon Mobil stocks are rising in price faster than oil. Exxon Mobil Corp CEO Darren Woods announced plans to cut staff. This can improve the company's financial performance. Previously, Exxon Mobil reduced operating costs by $1 billion and capital expenses by $10 billion. Now the company's stocks are traded near the 18-year low. At the same time, their dividend yield is the highest among American oil companies and amounts to 10.3%. Exxon Mobil's Q3 2020 earnings will be published on 30 October.

Terokai kami

Syarat Dagangan

- Tersebar dari 0.0 pip

- 30,000+ Instrumen Perdagangan

- Tahap Henti Keluar - Hanya 10%

Bersedia untuk Berdagang?

Buka Akaun Perhatian:

Kajian berikut adalah berdasarkan maklumat kognitif dan diterbitkan secara percuma. Semua maklumat, terkandung dalam semakan semasa, diperolehi dari sumber umum, diakui sebagai tidak tepat sepenuhnya. Oleh yang demikian tidak dijamin, maklumat yang dipaparkan adalah tepat dan lengkap sepenuhnya. Ulasan kemudian tidak dikemaskini. Segala maklumat pada setiap ulasan, seperti ramalan, petunjuk, carta dan seumpama dengannya, hanya disertakan bagi tujuaan rujukan, dan bukan sebagai nasihat kewangan atau cadangan. Kesemua teks dan sebahagian darinya, dan termasuk juga carta, sesama sekali tidak boleh digunakan sebagai cadangan untuk membuat sebarang transaksi untuk sebarang saham. Syarikat IFC Markets dan pekerjanya tidak akan bertanggungjawab di bawah mana-mana keadaan untuk segala tindakan yang diambil oleh sesiapa selepas atau semasa ulasan.