- Analisis

- Analisis Teknikal

S&P 500 Analisis Teknikal - S&P 500 Berniaga: 2020-09-18

Standard & Poor’s (500), Indeks pasaran saham Ringkasan Analisis Teknikal

Below 3309.83

Sell Stop

Above 3447.19

Stop Loss

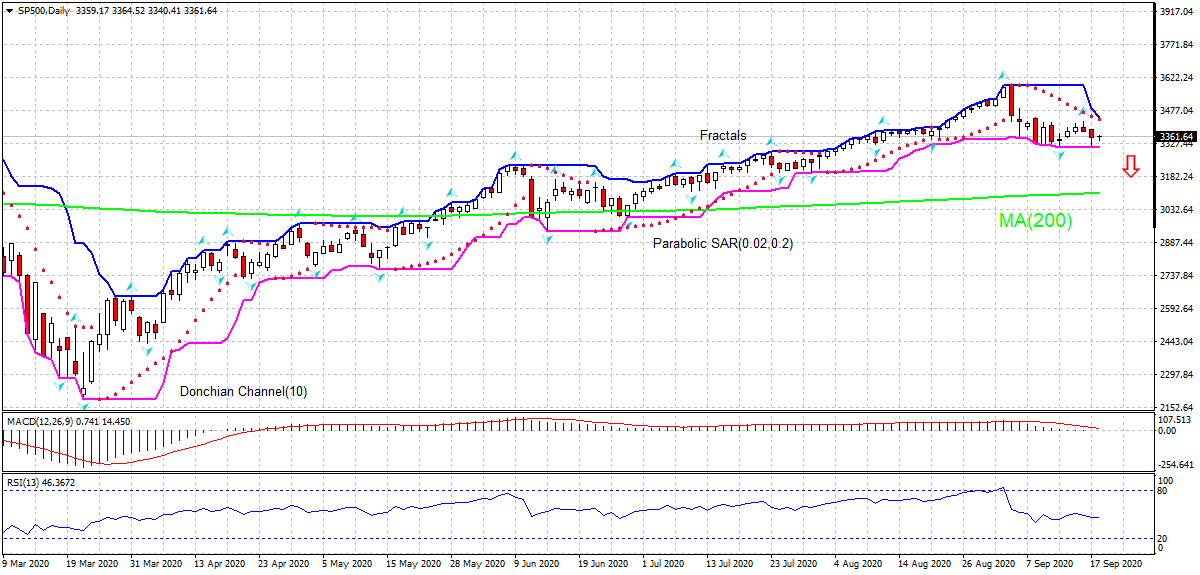

| Penunjuk | Isyarat |

| RSI | berkecuali |

| MACD | Sell |

| Donchian Channel | Sell |

| MA(200) | Buy |

| Fractals | berkecuali |

| Parabolic SAR | Sell |

Standard & Poor’s (500), Indeks pasaran saham Analisis carta

Standard & Poor’s (500), Indeks pasaran saham Analisis teknikal

On the daily timeframe the SP500: Daily is retreating after hitting all time high in the beginning of September, while still above the 200-day moving average MA(200) which is rising yet. We believe the bearish momentum will continue after the price breaches below the lower boundary of Donchian channel at 3309.83. A level below this can be used as an entry point for placing a pending order to sell. The stop loss can be placed above 3447.19. After placing the order, the stop loss is to be moved every day to the next fractal high, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (3447.19) without reaching the order (3309.83), we recommend cancelling the order: the market has undergone internal changes which were not taken into account

Analisis Asas bagi Indeks - Standard & Poor’s (500), Indeks pasaran saham

US economic recovery slowed in September. Will the SP500 retreat continue?

Recent US economic data were weak. The pace of economic recovery slowed in Philadelphia Federal Reserve district in September, the number of Americans who filed for unemployment benefits last week were higher than forecast, while US home builders started construction on new houses at higher pace in August. Thus, the Philadelphia Fed manufacturing index fell to 15 in September from 17.2 in prior month, initial jobless benefit claims increased 860,000 instead of forecast of 825,000, however housing starts rose 3% over year in August at a seasonally adjusted annual rate of 1.42 million. And with continuing claims at 12.63 million reflecting very elevated unemployment Fed chair Powell said it may take a long time for US economy to recover to full employment level. Weak economic data are bearish for SP500.

Terokai kami

Syarat Dagangan

- Tersebar dari 0.0 pip

- 30,000+ Instrumen Perdagangan

- Tahap Henti Keluar - Hanya 10%

Bersedia untuk Berdagang?

Buka Akaun Perhatian:

Kajian berikut adalah berdasarkan maklumat kognitif dan diterbitkan secara percuma. Semua maklumat, terkandung dalam semakan semasa, diperolehi dari sumber umum, diakui sebagai tidak tepat sepenuhnya. Oleh yang demikian tidak dijamin, maklumat yang dipaparkan adalah tepat dan lengkap sepenuhnya. Ulasan kemudian tidak dikemaskini. Segala maklumat pada setiap ulasan, seperti ramalan, petunjuk, carta dan seumpama dengannya, hanya disertakan bagi tujuaan rujukan, dan bukan sebagai nasihat kewangan atau cadangan. Kesemua teks dan sebahagian darinya, dan termasuk juga carta, sesama sekali tidak boleh digunakan sebagai cadangan untuk membuat sebarang transaksi untuk sebarang saham. Syarikat IFC Markets dan pekerjanya tidak akan bertanggungjawab di bawah mana-mana keadaan untuk segala tindakan yang diambil oleh sesiapa selepas atau semasa ulasan.