- Analisis

- Analisis Teknikal

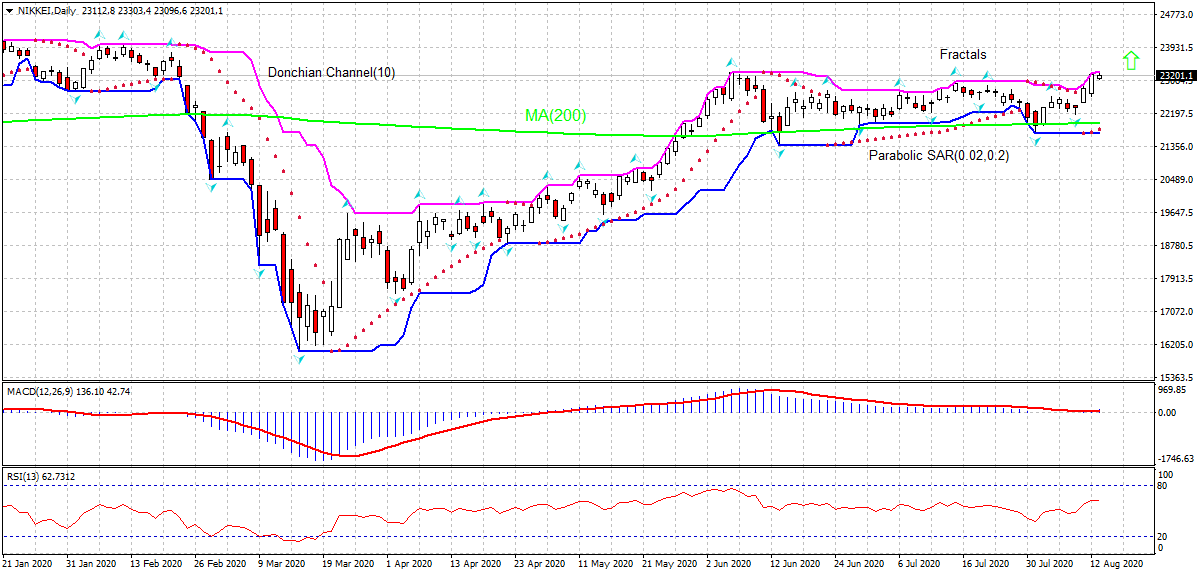

Nikkei Analisis Teknikal - Nikkei Berniaga: 2020-08-13

Nikkei (225), Indeks pasaran Saham Ringkasan Analisis Teknikal

Above 23303.4

Buy Stop

Below 21700.2

Stop Loss

| Penunjuk | Isyarat |

| RSI | berkecuali |

| MACD | Buy |

| Donchian Channel | Buy |

| MA(200) | Buy |

| Fractals | berkecuali |

| Parabolic SAR | Buy |

Nikkei (225), Indeks pasaran Saham Analisis carta

Nikkei (225), Indeks pasaran Saham Analisis teknikal

On the daily timeframe the Nikkei: D1 is rising above the 200-day moving average MA(200) which is rising tiself. We believe the bullish momentum will continue after the price breaches above the upper boundary of Donchian channel at 23303.4. A level above this can be used as an entry point for placing a pending order to buy. The stop loss can be placed below 21700.2. After placing the order, the stop loss is to be moved every day to the next fractal low, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (21700.2) without reaching the order (23303.4), we recommend cancelling the order: the market has undergone internal changes which were not taken into account

Analisis Asas bagi Indeks - Nikkei (225), Indeks pasaran Saham

Japan’s economic reports were mostly positive last week. Will the NIKKEI rebound continue?

Japanese economic data in the recent week were positive on balance. While machine tool orders declined over year more than forecast in July, the current account surplus rose in April and household spending decline over year was less than expected in June. And the producer prices decline over year was slower than forecast. Improving Japanese data are bullish for NIKKEI. On the other hand, preliminary Q2 GDP report will be published next Monday, and a steep drop in gross domestic report is expected. Worse than expected GDP report is a downside risk for Nikkei.

Terokai kami

Syarat Dagangan

- Tersebar dari 0.0 pip

- 30,000+ Instrumen Perdagangan

- Tahap Henti Keluar - Hanya 10%

Bersedia untuk Berdagang?

Buka Akaun Perhatian:

Kajian berikut adalah berdasarkan maklumat kognitif dan diterbitkan secara percuma. Semua maklumat, terkandung dalam semakan semasa, diperolehi dari sumber umum, diakui sebagai tidak tepat sepenuhnya. Oleh yang demikian tidak dijamin, maklumat yang dipaparkan adalah tepat dan lengkap sepenuhnya. Ulasan kemudian tidak dikemaskini. Segala maklumat pada setiap ulasan, seperti ramalan, petunjuk, carta dan seumpama dengannya, hanya disertakan bagi tujuaan rujukan, dan bukan sebagai nasihat kewangan atau cadangan. Kesemua teks dan sebahagian darinya, dan termasuk juga carta, sesama sekali tidak boleh digunakan sebagai cadangan untuk membuat sebarang transaksi untuk sebarang saham. Syarikat IFC Markets dan pekerjanya tidak akan bertanggungjawab di bawah mana-mana keadaan untuk segala tindakan yang diambil oleh sesiapa selepas atau semasa ulasan.