- Analisis

- Analisis Teknikal

MINYAK vs Gas Asli Analisis Teknikal - MINYAK vs Gas Asli Berniaga: 2018-11-28

OPEC and non-OPEC producers discuss the possible reduction in oil production

In this review, we suggest considering the personal composite instrument (PCI) &SumOIL/GAS. It reflects the price dynamics of the portfolio of futures on oil of two brands – Brent and WTI against futures on natural gas. Will SumOIL/GAS prices rise?Such a movement indicates that oil prices rise, while natural gas prices fall. In November, oil production rose to 11.7 million barrels per day and the production of shale gas also increased sharply in the US. In the Permian oil and gas basin located in the state of Texas, an excess of gas has been formed on Waha hub site and its price has fallen by 80% to a historical low since the start of operation of this site in 1991. Market participants do not exclude the reduction of gas prices on other American sites, including Henry Hub in Louisiana. According to U.S. Commodity Futures Trading Commission (CFTC), there was a massive closure of long positions on the purchase of gas on the New York Mercantile Exchange (NYMEX) last week. It turned out to be the 3rd largest closure since 2006. An additional negative factor for US natural gas prices was the warm weather in the United States, which reduces its demand for heating purposes. Meanwhile, the average gas production in the United States for the last 30 days reached a historic high and amounted to 87.2 billion cubic feet per day. The cost of oil is now correcting upwards in anticipation of the possible reduction in OPEC production at the next meeting on December 6, 2018, as well as the reduction in the intensity of the trade war between the US and China amid their meeting at the G20 summit at the end of this week.

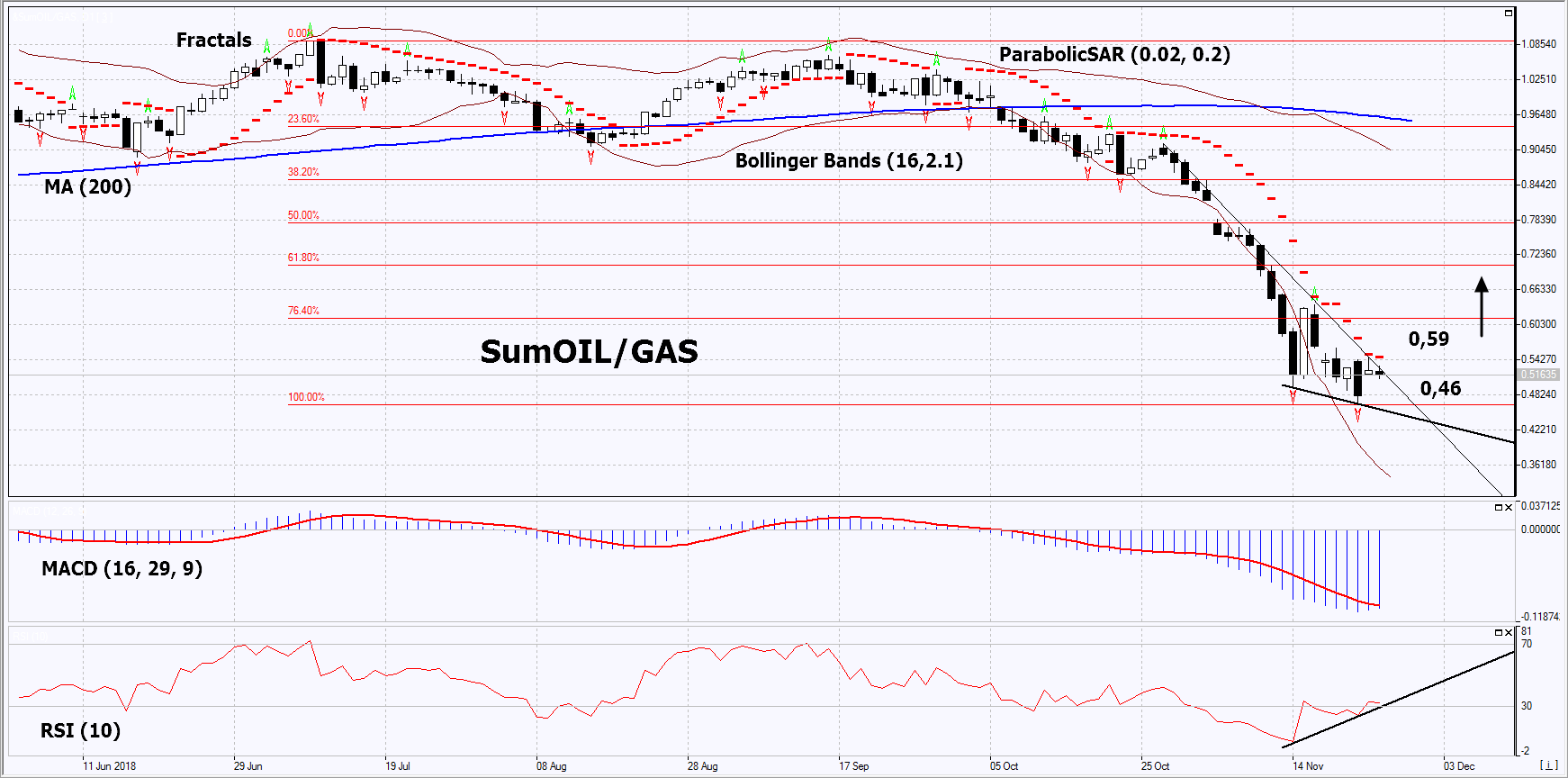

On the daily timeframe, SumOIL/GAS: D1 has updated the low since March 2009 and is trying to correct up within the downtrend. A number of technical analysis indicators formed buy signals. The further price increase is possible in case of a reduction in oil production of OPEC and non-OPEC producers and an excess of natural gas in the US.

- The Parabolic indicator gives a bearish signal. It can be used as an additional resistance level, which must be overcome before opening a buy position.

- The Bollinger bands have widened strongly, which indicates high volatility.

- The RSI indicator is below 50. It has formed a positive divergence.

- The MACD indicator gives a bullish signal.

The bullish momentum may develop in case SumOIL/GAS exceeds the Parabolic signal at 0.59. This level may serve as an entry point. The initial stop loss may be placed below the last fractal low and the low since March 2009 at 0.46. After opening the pending order, we shall move the stop to the next fractal low following the Bollinger and Parabolic signals. Thus, we are changing the potential profit/loss to the breakeven point. More risk-averse traders may switch to the 4-hour chart after the trade and place there a stop loss moving it in the direction of the trade. If the price meets the stop level (0.46) without reaching the order (0.59), we recommend to close the position: the market sustains internal changes that were not taken into account.

Summary of technical analysis

| Position | Buy |

| Buy stop | Above 0.59 |

| Stop loss | Below 0.46 |

Perhatian:

Kajian berikut adalah berdasarkan maklumat kognitif dan diterbitkan secara percuma. Semua maklumat, terkandung dalam semakan semasa, diperolehi dari sumber umum, diakui sebagai tidak tepat sepenuhnya. Oleh yang demikian tidak dijamin, maklumat yang dipaparkan adalah tepat dan lengkap sepenuhnya. Ulasan kemudian tidak dikemaskini. Segala maklumat pada setiap ulasan, seperti ramalan, petunjuk, carta dan seumpama dengannya, hanya disertakan bagi tujuaan rujukan, dan bukan sebagai nasihat kewangan atau cadangan. Kesemua teks dan sebahagian darinya, dan termasuk juga carta, sesama sekali tidak boleh digunakan sebagai cadangan untuk membuat sebarang transaksi untuk sebarang saham. Syarikat IFC Markets dan pekerjanya tidak akan bertanggungjawab di bawah mana-mana keadaan untuk segala tindakan yang diambil oleh sesiapa selepas atau semasa ulasan.