- Analisis

- Analisis Teknikal

NZD/JPY Analisis Teknikal - NZD/JPY Berniaga: 2018-10-31

Normalization of the US-China relations may support the New Zealand dollar

US President Donald Trump announced that he is going to make a big deal with China. This can reduce the intensity of mutual trade wars. Will the NZDJPY rise?

Such a move indicates the strengthening of the New Zealand dollar against the Japanese yen. China is an important trading partner of New Zealand. The normalization of its relations with the US can support the New Zealand currency. In turn, the attractiveness of the yen as a safe haven asset in Southeast Asia may decline. Earlier, the United States increased import duties on Chinese goods worth $250 billion a year. China in response, increased duties on US goods worth $110 billion a year. The next meeting of the Bank of Japan will be held on October 31. As expected, it will keep the loose monetary policy and the rate (-0.1%), which may become an additional negative factor for the yen. The next meeting of the Reserve Bank of New Zealand will take place on November 7. According to forecasts, it will not change the current rate (+ 1.75%). The difference in interest rates can contribute to the increase in the NZDJPY currency pair.

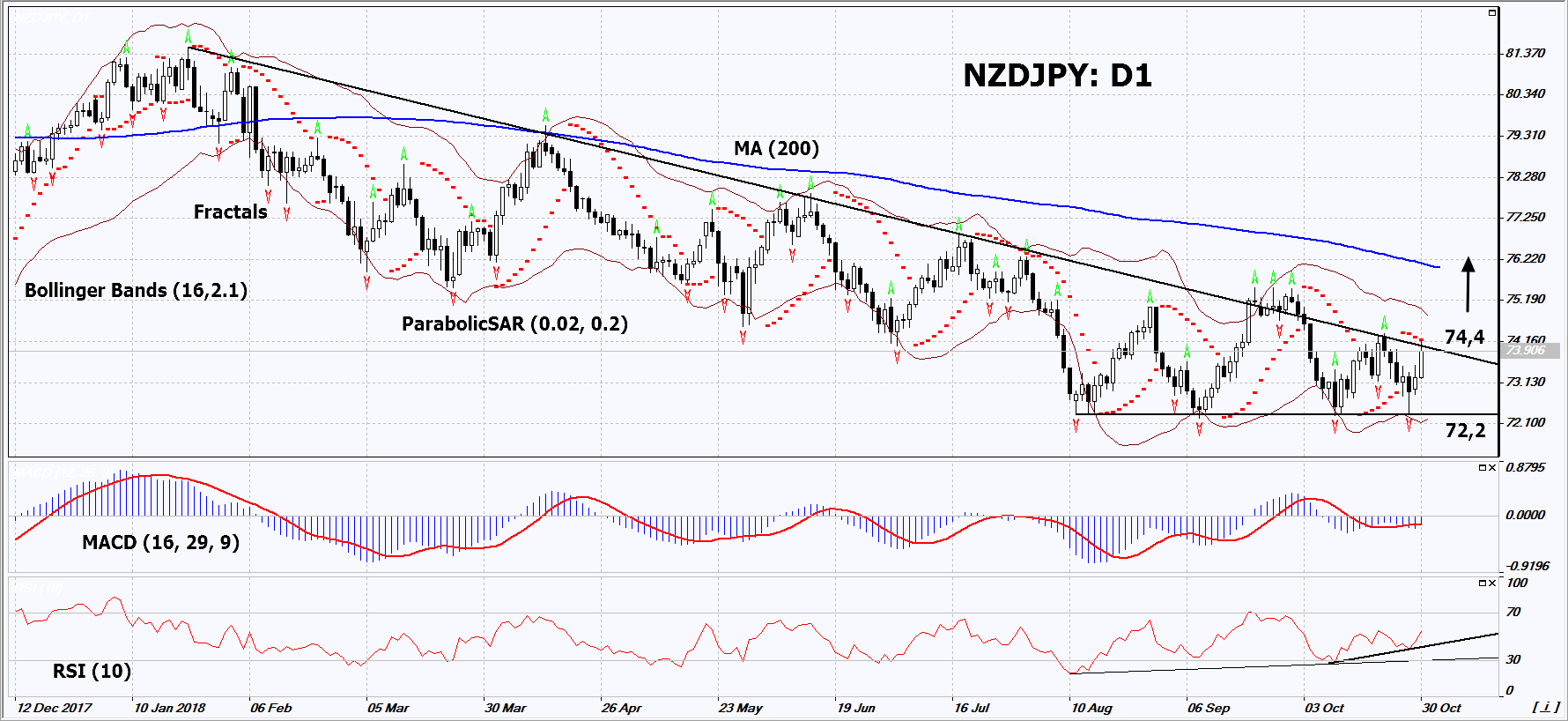

On the daily timeframe, NZDJPY: D1 approached the resistance line of the downtrend. It must be overcome before opening a buy position. A number of technical analysis indicators formed buy signals. The further price increase is possible in case of the worsening of economic indicators of Japan and their improvement in New Zealand.

- The Parabolic indicator gives a bearish signal. It can be used as an additional resistance level, which must be overcome before opening a buy position.

- The Bollinger bands are narrowing, which indicates low volatility.

- The RSI indicator is above 50. It has formed a positive divergence.

- The MACD indicator gives a bullish signal.

The bullish momentum may develop in case NZDJPY exceeds the last fractal high, the resistance line of the downtrend and the Parabolic signal at 74.4. This level may serve as an entry point. The initial stop loss may be placed below the 4 last fractal lows and the low since August 2016 at 72.2. After opening the pending order, we shall move the stop to the next fractal low following the Bollinger and Parabolic signals. Thus, we are changing the potential profit/loss to the breakeven point. More risk-averse traders may switch to the 4-hour chart after the trade and place there a stop loss moving it in the direction of the trade. If the price meets the stop level (72.2) without reaching the order (74.4), we recommend to close the position: the market sustains internal changes that were not taken into account.

Summary of technical analysis

| Position | Buy |

| Buy stop | Above 74,4 |

| Stop loss | Below 72,2 |

Perhatian:

Kajian berikut adalah berdasarkan maklumat kognitif dan diterbitkan secara percuma. Semua maklumat, terkandung dalam semakan semasa, diperolehi dari sumber umum, diakui sebagai tidak tepat sepenuhnya. Oleh yang demikian tidak dijamin, maklumat yang dipaparkan adalah tepat dan lengkap sepenuhnya. Ulasan kemudian tidak dikemaskini. Segala maklumat pada setiap ulasan, seperti ramalan, petunjuk, carta dan seumpama dengannya, hanya disertakan bagi tujuaan rujukan, dan bukan sebagai nasihat kewangan atau cadangan. Kesemua teks dan sebahagian darinya, dan termasuk juga carta, sesama sekali tidak boleh digunakan sebagai cadangan untuk membuat sebarang transaksi untuk sebarang saham. Syarikat IFC Markets dan pekerjanya tidak akan bertanggungjawab di bawah mana-mana keadaan untuk segala tindakan yang diambil oleh sesiapa selepas atau semasa ulasan.